A more practical life skills course: State creates a new personal finance course to equip seniors for real life outside of school

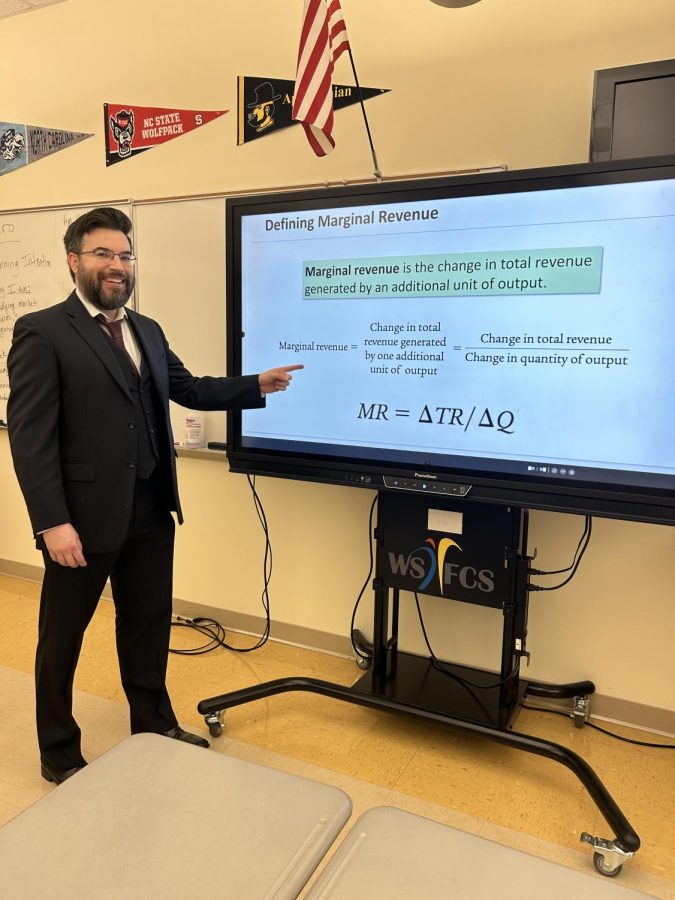

Photo provided by Jackson Fromm.

Miles instructing the class on a fundamental financial and economic concept.

March 17, 2023

Next school year, North Carolina unveils a new class for all high school students, the Economics and Personal Finance (EPF) course. All students will be required to take EPF to graduate. The course aims to educate students with basic economic and financial knowledge to prepare them for life after high school.

“[The course] was born out of a member of our state’s congress, who was talking to a recent high school graduate, and realized that they didn’t have a good foundational knowledge of economics and personal finance,” Career Center Economics and EPF Certified Teacher Ryan Miles said. “So the state came up with a course, or proposed a course, that would give everyone some sort of foundational knowledge before they had to make big decisions about college debt, or start their careers, anything along that nature as a young adult.”

EPF, intended to be a senior year class, and taught at both the standard and honors level, will include a variety of financial skills- lessons ranging from micro and macroeconomics, taking out debt for colleges, insurance, managing a financial portfolio, and more. For the first year of rollout in the 2023-2024 school year, the class will not have an end-of-year state-administered exam, which is expected to be added soon. Miles believes this will push the development and standardization of the course and boost confidence that students know the course material well enough to make intelligent decisions after graduation.

This new course is changing how students navigate their high school course load. Starting this school year, the sophomore class “Civics and Economics” dropped the econ portion and became “Civic Literacy” in preparation for economics to be taught in students’ senior year with EFP. This significant change was a state decision, and local school board members did not necessarily agree.

“I don’t necessarily agree that creating a whole new graduation requirement was the best way to do that,” WSFCS Board of Education Vice Chair Alexandre Bohannon said. “I think that there were opportunities within the current Civics and Economics curriculum to be able to address that a little bit better.”

While students will learn practical and valuable information for life after high school, this knowledge comes at a cost. With the insertion of the new class into all seniors’ schedules, they are stripped of a class period that could be used to take an elective or another course that they would prefer, restricting their freedom to schedule to their desire.

“When you add another required course to it, that decreases the flexibility of students’ abilities to choose a course that they like,” Bohannon said. “I think that is something that, to me, is a little bit of an issue because we want students to have as much freedom as possible in their course selection.”

This may inflate worries over the number of APs taken or affect class rank, but students must remember that they will share the same circumstances with all other North Carolina high schoolers.

“I think [the class] will probably be useful in years to come, and, surprisingly, they haven’t had it as a class sooner,” junior Molly Stitzel said. “I am a little annoyed about it taking up schedule space, but it doesn’t bother me too much since everyone has to take it. They also made it available as a year-long and block [class] at both Reynolds and Career Center, which is helpful.”

Not only new and unfamiliar for students, but teachers must also learn the ins and outs of instructing an entirely new class for the first time. To prepare them, the state requires that teachers complete a 40-hour professional development provided by the NC Council for Economic Education. Miles had to pass two tests at the end, one state and one national, to become EPF certified. Aside from having proficient knowledge of the topics they will cover, teachers have a brand new curriculum to become comfortable with and teach. To assist teachers during this early stage of the class, the district is providing help to make this change smoother.

“In addition to the resources and training that teachers receive from that requirement, our district also has unit planning organizers with structure and resources for teachers as a support for teaching the course,” WSFCS Director of Social Studies Courtney Tuck said. “We have a district social studies coach that is also available to meet with teachers as an additional resource and support. In addition to these supports, we will create and encourage collaboration groups for teachers to work together as they navigate this course for the first time next year.”

As students have different backgrounds outside of school on these financial topics, it is essential that the school can offer an opportunity for all students to learn equally about these important lessons.

“I believe that a lot of financial knowledge and common sense knowledge when it comes to managing your finances is no longer a requisite dinner table discussion for everyone,” Miles said. “Different families have different schedules, and I think… Every student benefits from a foundational knowledge of economics and finance, even if that’s not the career you want to go into. It helps you become better off at life because you avoid making bad decisions that have bad economic outcomes for your family.”

The EPF course is designed to educate students on key, practical lessons on their financial life. This will elevate high school graduates to become confident and prepared for life.